As a couple pursuing FI/RE (financial independence, retire early) while traveling full time, we’re very aware of our budget and what we spend year over year. We’ve been intentionally and slowly increasing our spending each year (just three years ago we were spending only $7,000 a year!), but this year came in at an 80% increase over last year because we had a baby! Read on to see how we continued to save money, where we increased our spending, and how we’re continuing to travel full time as digital nomads with an infant.

All in Financial (FIRE)

DIY – How to Hack $30+ Travel Packing Cubes (2022 UPDATE)

How to make a cheap alternative to store bought packing cubes by making your own DIY Travel Packing Cubes (and reinforcing them if needed), no sewing required! Plus, see our review and what’s worked best after nearly six years of long-term travel as digital nomads across four continents, 26 countries and 100+ cities!

2021 Budget and Lifestyle: Living on $10,000 as Digital Nomad House Sitters

Another year down as digital nomad house sitters pursuing FI/RE (financial independence, retire early) and we’re happy to share our 2021 budget and expenses. We spent $10,002 for the entire year ($5,001 apiece) all-in! Now, if you follow us, you know that number blows our usual $7,000 budget out of the water, so read on to see where we spent more money and why.

Be an Outlier. Interview Series | Meet Dan, FI/RE'd & Slow Traveling

In the third edition of our Be And Outlier interview series, we’re excited to talk with Dan who fired his boss and has been traveling the world for over thirteen years! Along the way he’s met his partner Qiang Hui, started a vlog, created a successful online business, and teaches others how they can also retire cheaply abroad.

2020 Budget and Lifestyle: Living on $7,000 a Year During COVID-19

It was unbelievable that we lived on $7,000 ($3,500 each) for a whole year in 2019. So, it’s incredible that we did it again in 2020! See how in 2020 we managed to keep our spending low despite the upheaval COVID-19 brought the world.

Be an Outlier. Interview Series | Meet Bryce, A Focused Minimalist’s Approach to FI/RE

In the second edition of our Be And Outlier interview series, we’re excited to talk with Bryce, who’s where we hope to be soon: FI/RE’d! Hearing his story and how he, as a retired engineer in management looks at the details in the process, is frugal, aspires to travel, and had supportive good role models along the way is inspiring. Read on to see him pull back the covers and share insightful advice as well as his bumps and bruises along the way.

February & March 2020 Real World Travel, Budget, Deal, and Life Hacking

Unfortunately, because of the Covid-19 (SARS-CoV-2) pandemic life has changed for the foreseeable future. However, that doesn’t mean that our budget, deal, and life hacking has stopped. In fact, we even got in some travel hacking these last two months!

Be an Outlier. Interview Series | Meet the Satchells, FI/RE with a Focus on Family

In our inaugural interview we’re bringing you the Satchell family, who aren’t only pursuing financial independence, retire early (FI/RE) but are doing it with with a young and growing family, a rarity by most FI/RE standards. See what they’ve learned about themselves through travel in Mexico and what ultimately brought them home.

January 2020 Real World Travel, Budget, Deal, and Life Hacking

It’s a new year and we kicked it off with taking advantage of many deals and hacks to save money and improve our life this month!

How We Lived on $7,000 ($3,500 each) All-Inclusive for One Year

Want to lower your expenses and improve your budget? Are you looking to be financially independent and retire early (FI/RE)? We’ve found creative, extreme, and simple ways to lower our expenses while traveling as digital nomads, all while pursuing FI/RE. See how we lived on $7,000, all-inclusive last year. That’s just $3,500 each!

December 2019 Real World Travel, Budget, Deal, and Life Hacking

We ended the year with a month full of deal stacking, cashback offers, travel hacking with miles and points, and more! Not to mention, we completed another month of house sitting which cut our lodging budget to less than $50 this month. If you’re looking for ideas to cut your monthly expenses, travel for less, or just score some great deals, you’re in the right place!

December 2019 Budget & Expenses | Digital Nomads Pursuing Financial Independence, Retire Early (FI/RE)

We’re closing out the budget for the year and we’re excited to see that for our year of domestic travel we’ve actually cut our ‘year-in-Europe’ budget by over half! See some of the ways we spent under $7,000 (that’s only $3,500 each!) as digital nomads traveling the US, including several months around the New York City area.

November 2019 Budget & Expenses | Digital Nomads Pursuing Financial Independence, Retire Early (FI/RE)

This month we topped the scales and spent the most we have in a single month for this entire year, just over $800. Read on to see where we put our extra dollars this month and were we saved big!

November 2019 Real World Travel, Budget, Deal, and Life Hacking

This month’s life hacking digest is full of deal stacking, credit card offers, hotel points, airline miles, lodging hacking, and much more. There’s even a few new and ongoing offers that came up this month! Read on to see how we made hundreds of dollars in points and miles, saved hundreds with deal stacking, and spent only $36 in lodging costs.

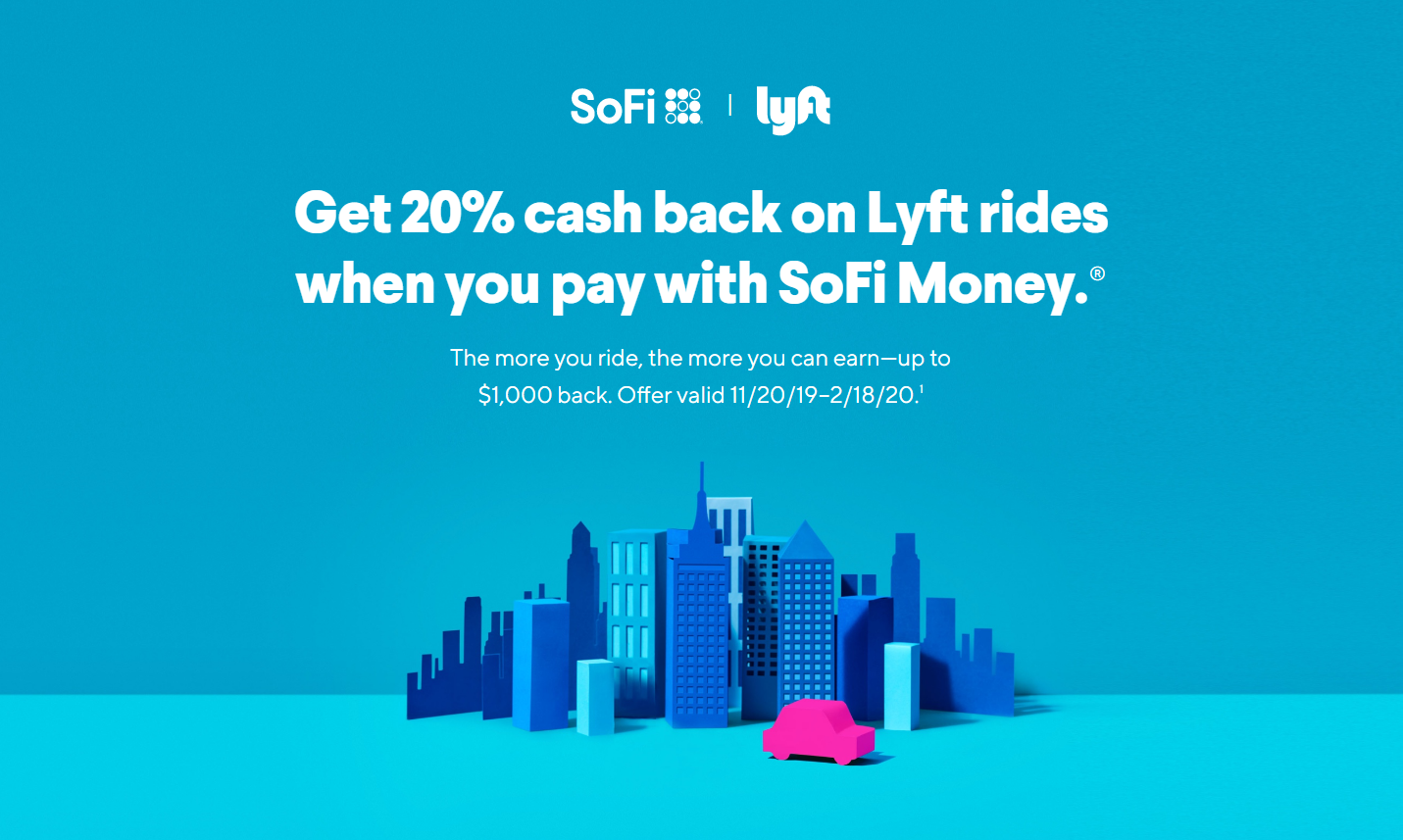

Get 20% Cash Back On All Lyft Rides with SoFi Money

Pay for your Lyft rides with your SoFi Money account and earn 20% cash back, up to $1,000!

October 2019 Budget & Expenses | Digital Nomads Pursuing Financial Independence, Retire Early (FI/RE)

We never really thought that a month of expenses while visiting New York City could be done for anywhere near $600, but we did it! We did sightseeing, lived in comfortable homes, ate well, and lived a pretty good life this month. Plus, we’re one month closer to financial independence, retire early (FI/RE) and loving our lives as full time house sitters and digital nomads.

October 2019 Real World Travel, Budget, Deal, and Life Hacking

We have a goal of financial independence, retire early (FI/RE) and long term travel, which means we’re hard at work making sure it happens. We have many travel, budget, deal, and life hacks in our tool box and are always on the lookout for new ones. Check out what we did last month, hopefully it inspires you!

September 2019 Budget & Expenses | Digital Nomads Pursuing Financial Independence, Retire Early (FI/RE)

Our monthly budget for two came in at just over $700 this month. Not bad considering we were in New York City! See how we’re outliers when it comes to our budget as we pursue financial independence, retire early (FI/RE).

Making an Easy $300+ with SoFi Money, Invest, and Loan Referral Program | Make Up to $10,000

Make an easy return on your money by participating in Sofi’s referral program. It’s as simple as opening a SoFi Money account through a referral link and depositing $100. That’s all it takes to get a $50 bonus added to your account. Then, get $100 for every person, friend, and family member who opens an account with your referral link.

Turn around and do the same with a SoFi Invest account and get another $50 bonus for opening the account and then $50 for anyone who does the same with your referral link.

Additionally, apply for and get a SoFi Personal Loan, or a SoFi Student Loan Refi to earn a $100 bonus and then $300 for anyone who uses your referral link. In total you can earn up to $10,000!

September 2019 Real World Travel, Budget, Deal, and Life Hacking

We earned a lot of miles and points this month between flights on Delta, hotel stays with Marriott, and a bunch of Lyft rides. Not to mention, we were approved for a few credit cards that offered attractive sign-up bonuses. Read on to see what deals and life hacking we took advantage of in September.